Indian budgets traditionally used to be announcement of changes in direct and indirect taxes, or subsidies. This budget in particular, stands out, as an attempt to charter a new course. The primary role of government is to define policies to create new vistas for growth, and empower entrepreneurs in society.

For instance, the most daring direction setting initiative in the General Budget 2020 is on agricultural front, vide ‘krishi-udan’. Let me elaborate on this. For several years now, the rural economy has been under distress, as a result of rising uncertainty in the agriculture sector. This affects the economy as 80% of farmers have small land holdings of 2 to 3 acres or less.

While about two lakh farmers have committed suicide (over the few decades), the only ways all past governments have responded, is through subsidies such as loan-waivers or providing free food, etc. In this backdrop, schemes like krishi-udan announced in this Budget 2020 can be a real trigger and game-changer and contribute towards 3 to 4 % fresh GDP growth by converting rural economy completely entrepreneurial.

Rural India, inhabited by two third population, badly awaits new wealth creation opportunities. The micro-level ideas like creation of storage in rural areas, owned by locals, may not attract much attention, yet this is how villagers would transform into being entrepreneurs.

Growth of rural prosperity would eventually set the course for reversal of migration from masses living in unhygienic slums in cities to being back to their native villages. When implemented in full scope, rural wealth creation initiatives can set the direction for growth for new generation farmers and people living in the villages.

Another first in this budget is the policy to initiate the charter for taxpayers, which has potency to make the whole taxation-machinery reduce to a minimal, and open a new vista of trust based tax collection system. Once again, this is a directional shift if implemented in truest spirit. Cost of tax collection is an overhead on the economy, which needs to be as low as possible. On the other hand, it would empower entrepreneurs, who prefer a genuine approach to grow and contribute to nation building. We have indeed come a long way from the era of license raj that treated entrepreneurs as a person of greed who needed to be punished.

Moreover, the environment of tax certainty and incentives would enhance reasons for global entrepreneurs to invest in long term growth story of India.

Many from the established large businesses, such as auto, pharma, etc, may feel disillusioned by this budget, as it would not help their existing activities. Their worry is real, as they have to be prepared for natural shifts taking place in the nature of the demand globally. For instance, preventive healthcare in the case of pharma or lifestyle etc. This is because the younger generations are concerned about sustainability and equity. No government can help them on issues related to business models.

Advantages offered to salaried income tax payees are quite obvious and would naturally help the economy in the immediate term through greater disposable money in consumer hands. A shot to GDP growth, a notch or two.

A lot remains to be done though, from immediate gains perspective. Speculation in real estate prices, which zoomed 1000% from 2004-14, although stagnant in last five years, still awaits policy-based corrections. This colossal price increase has been a substantial reason behind slowdown. A quick, back-of-the-envelope estimate suggests that every 10% reduction in real estate price can add more than 1% to the national GDP. Compared to the 10-fold price rise during 2004-14, even 50% fall would still be 5-times compared to the price of 2004. New and immediate job creations would come essentially from the infrastructure sector both in rural and urban areas, but they are short term solutions. One needs to estimate the real number of jobs this budget would create, based on proposed investments.

However, stable and quality job creations require domain specific incentives to the MSME (Micro, Small and Medium Enterprises), which is not obvious in this budget.

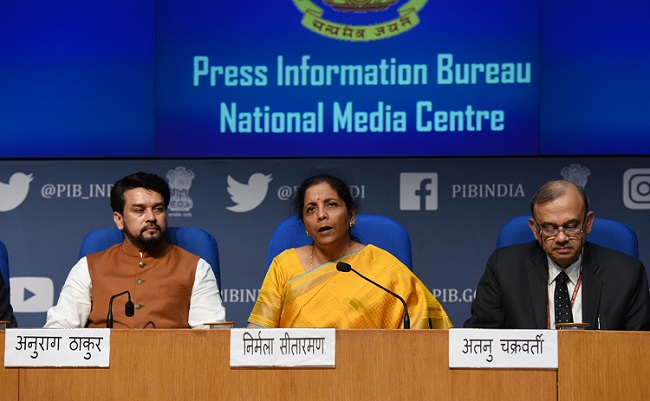

While critiques in days ahead would churn out gaps between what is proposed and what they would be able to achieve, one thing is certain. Finance Minister Nirmala Sitharaman and team clearly demonstrate how carefully they have been listening to diverse voices, and hold a 360-degree vision. From rural at one end to quantum at the other, they have tried to pay attention to every possible level of the economic ladder. Right from creating online educational opportunities in top institutes for disadvantaged individuals to individual solar pumps for farmers on one hand, to innovative initiatives like five archaeological centres to thinking about frontier technologies like Artificial Intelligence and machine learning is a tribute to Sitharaman’s effort to define the Mount Everest that India needs to climb.

On the whole this budget represents a good comprehensive proactive approach, having breadth and depth, across the whole economy. Multiple new initiatives are encouraging.

However, the challenges lie in being truly effective and living upto declaration of removing conventional hurdles for entrepreneurs.

Long term challenges that remain to be addressed, however, are quite a few and would hopefully get the attention of policy makers someday, I hope. For instance: When would the nation be ready to develop multi level entrepreneurial ecosystem, which can easily identify each aspiring first-generation entrepreneur and ensure a specific pathway to break even and grow. The challenge is about how to create a million entrepreneurs, at all levels. Likewise, when would the nation be ready to honour knowledge as capital and India becomes a hub of pioneering innovations and excellence. So, although this budget is a step in the right direction, policy makers have a lot to do, to reach India to her fullest aspirations, that cannot be measured merely in quantitative terms.