As Prime Minister Narendra Modi announced a three week lockdown, India needs to start preparing for no-growth or even a contraction of the economy in its very first quarter of the new financial year. While many think tanks and rating agencies have slashed India’s growth projections, RBI said on Friday that with an unprecedented situation arising due to the spread of COVID 19, it’s difficult to come up with any growth projection.

Needless to say that the unorganised sector, which employs over 75% of the country’s workforce will be the worst impacted. A State Bank of India report suggested that the total cost of the lockdown could be Rs 8.03 lakh crore.

Sectors such as hospitality, aviation, tourism, trade, and the micro, small and medium enterprises among others will witness the maximum income and job losses in the coming months. It is important for the government to start preparing a concrete package for these sectors immediately so that it can be rolled out right after life comes back to normal. The sudden lockdown, which has forced thousands of migrant workers to return to their home towns and villages, will lead to an exponential rise in the unemployment numbers.

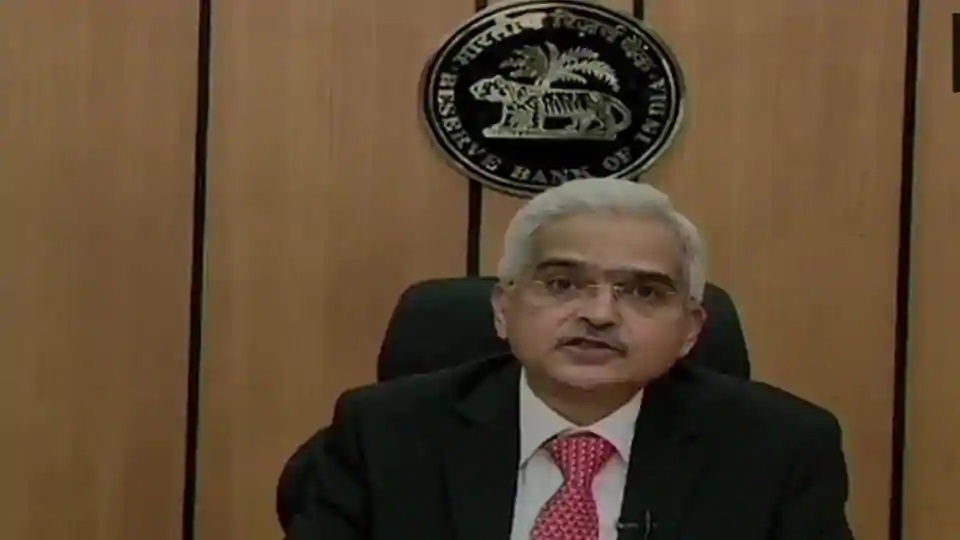

The Reserve Bank of India (RBI) announced a slew of measures leading to an additional liquidity injection of Rs 3.74 lakh crore into the system –nearly 2% of the GDP. Finance minister Nirmala Sitharaman has already announced a Rs 1.7 lakh crore relief package for the poor.

Both these moves are much needed to combat the severe economic impact in the wake of the spread of the novel Coronavirus.

The monetary policy committee of RBI met on Friday, much ahead of its scheduled meet slated in April. RBI has reduced the repo rate—the rate at which banks borrow from RBI—by 75 basis points to 4.4% besides bringing down the mandatory cash reserve ratio (CRR) — the proportion of deposits banks have to mandatorily park with the central bank — by 100 basis points to 3% with effect from March 28 for a period of one year. This move alone will inject Rs 1.37 lakh crore into the banking system. The reverse repo rate, too, was lowered by 90 basis points.

This is also the time to go aggressive with Make In India programme to reduce dependence on imports.

If India has to reduce the shock of COVID-19, it needs to act fast and in addition, it may be a good idea for RBI to look at taking the non-conventional route to ensure that the economy is kick-started without much hiccup.