- “Demonetisation” is shown within double inverted commas since the 8th November 2016 action / process followed is not Demonetisation as defined in true macro-economic parlance.

- Also – and more importantly – because the RBI Act, 1934 itself does not contain this term “Demonetisation” anywhere.

Though the subject of “Demonetisation” was national news way back in November 2016, the matter has gained fresh importance since the startling revelations of the Minutes of the Meeting of RBI’s Central Board of Directors held on 8th November 2016, became public knowledge as recently as 8th March 2019 when RTI Activists did the nation a great favour by pursuing the official procurement of this vital document from RBI and publishing these Minutes for the benefit of our public. The valuable content of these Minutes provide specific details of the steps preceding the announcement of Demonetisation by the Prime Minister on 8th November 2016. It also helps gain insight into the propriety of actions taken by the Government and their compliance with the prescriptions contained in the RBI Act of 1934 and in the RBI Regulations, 1949 which are adjunct to the main Act.

As is well-known, the ultimate responsibility of managing the country’s monetary resources rests with the RBI, which is required to follow the Act and Regulations referred above. Also, the Government of India is expected to conduct itself in a manner which respects and complies with the RBI Act in all matters relating to our Country’s Monetary Policies and Practices.

We shall now dwell deep into each of the important issues concerning the actions of the Government of India in respect of “Demonetisation”. It is important for intelligent nationalists to review the actions of the Government in order to attain a proper understanding of the propriety of the Government’s actions and gauge their enduring impact and value on our economy and on the lives of our people.

Before proceeding, it is clarified that this analysis is not intended to criticise the Government or its actions. It is purely a macro-economic analysis of the actions of the Government viewed against the back drop of prescribed Legal and Administrative processes which ought to have been followed. If these aspects were not dealt with in accordance with the RBI Act, it is up to the thinking public to draw judgment on the entire exercise and voice their collective opinion resulting from a careful comprehension of the various points explained below in an unbiased and professional manner.

Several Key Documents are attached to this submission:

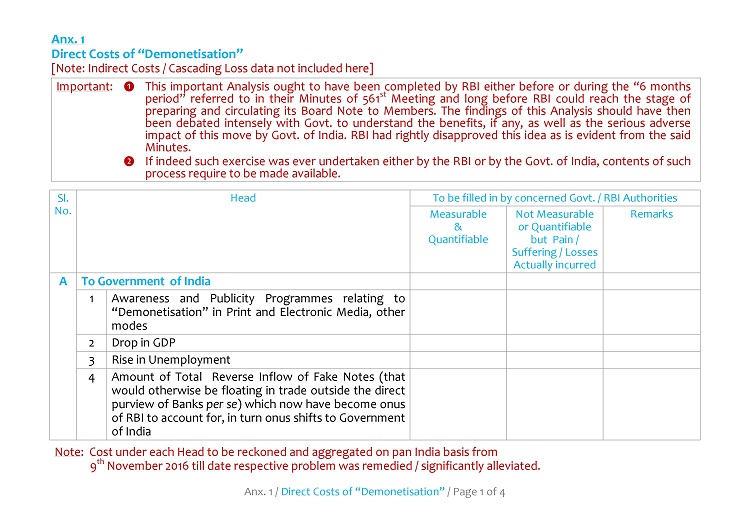

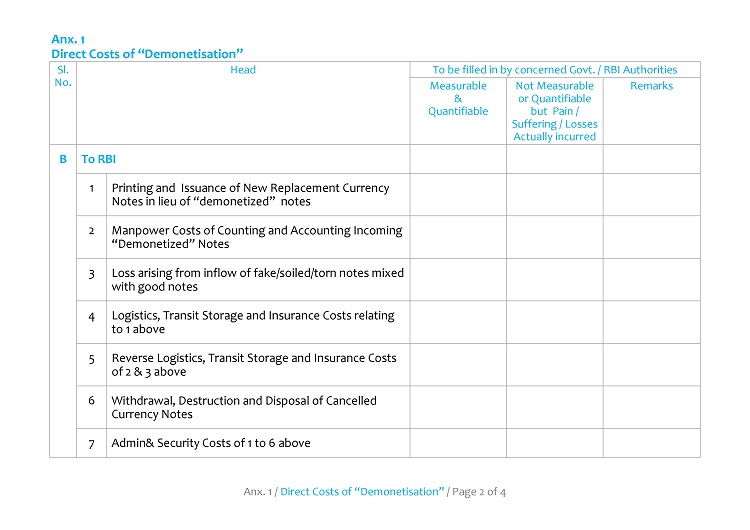

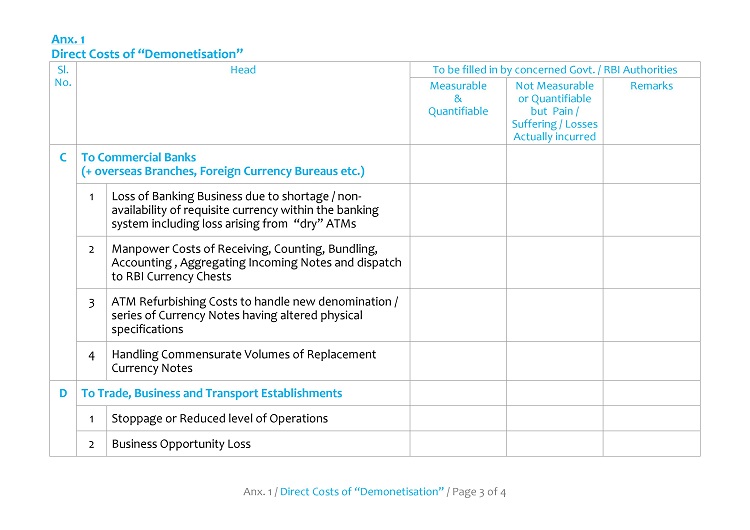

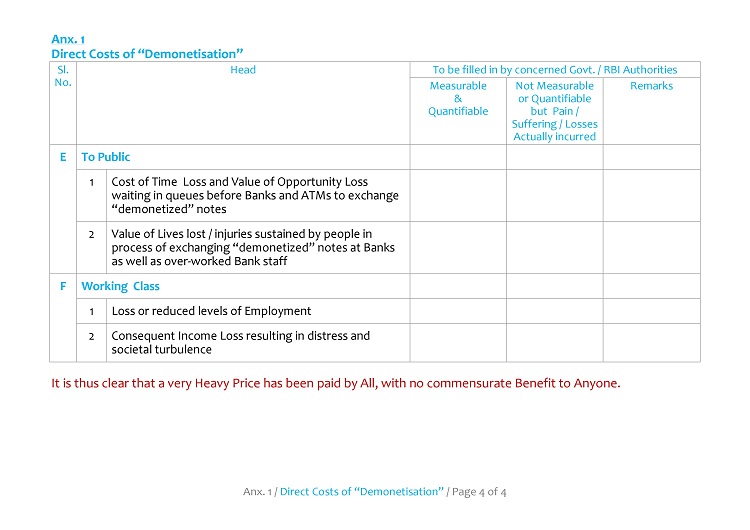

Annexure 1 is a Chart titled: “Direct Costs of Demonetisation”. Its data is to be filled in by the concerned Authorities to quantify, wherever possible, the extent of loss/physical damage caused by “Demonetisation”. Many of the events of loss/damage can be measured in monetary terms. We have catalogued the illustrative list of losses under various heads with the desire and expectation that concerned Authorities will do justice by providing the requisite data. However, many of these data can be expressed only in non-monetary terms. It is necessary to understand the aggregate damage caused to the country and its people by this action of the Government. Of course, readers are also free to contribute in this regard.

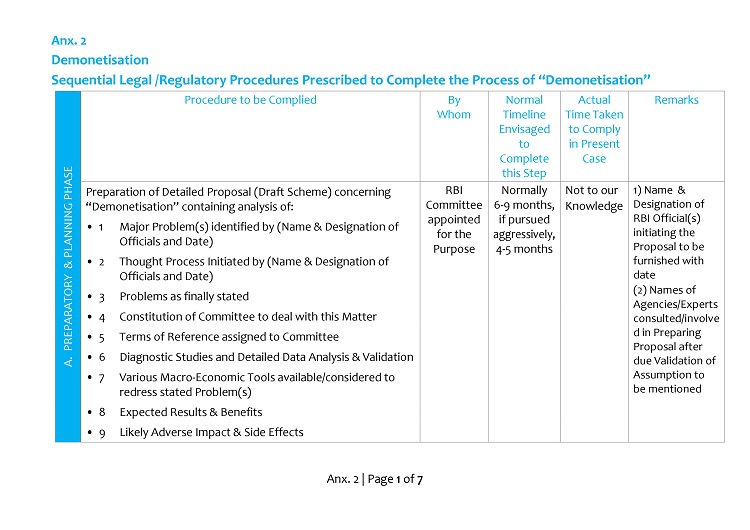

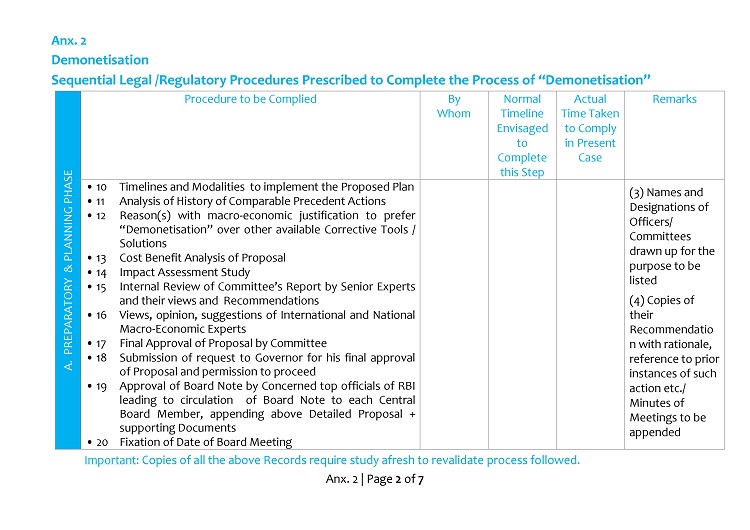

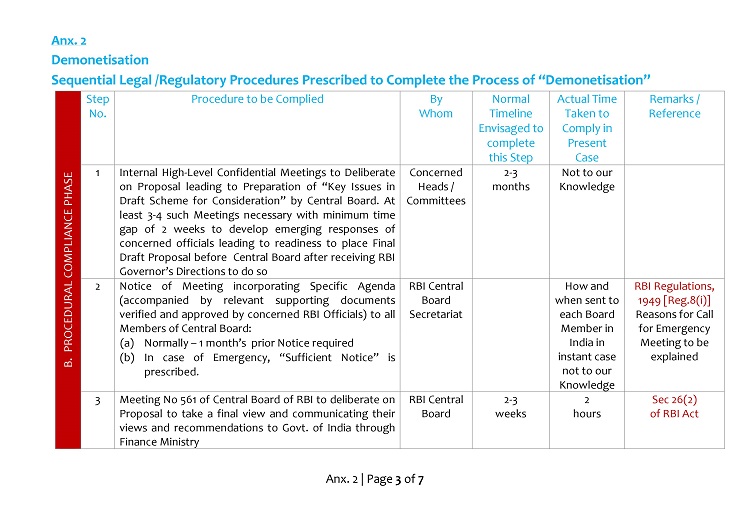

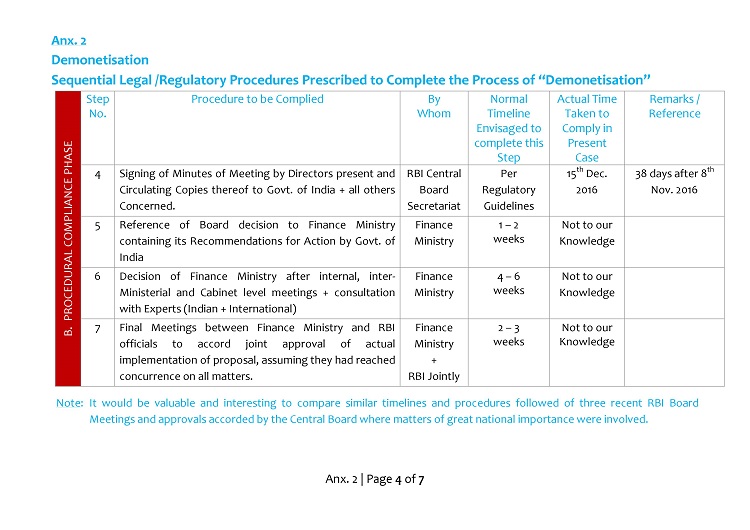

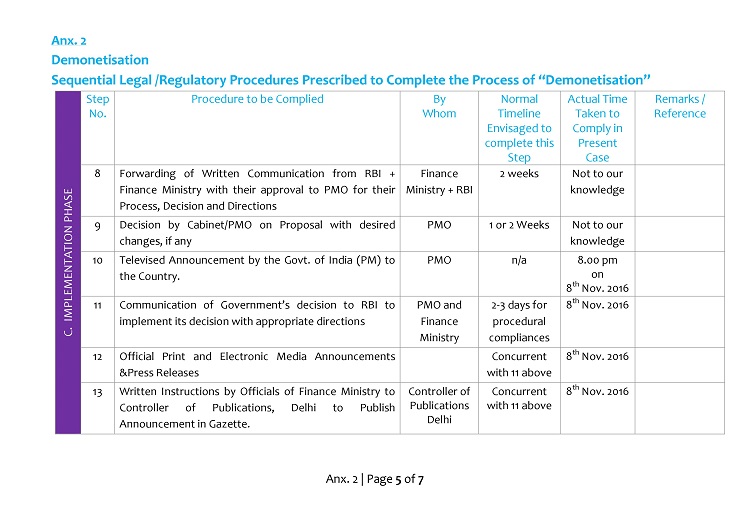

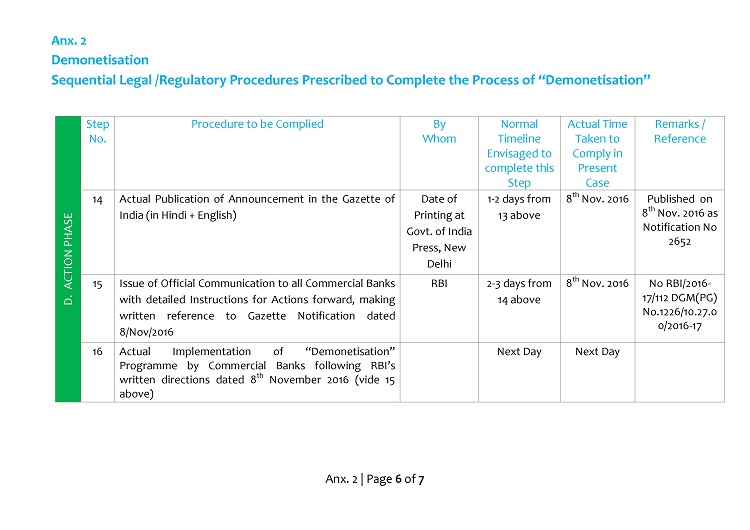

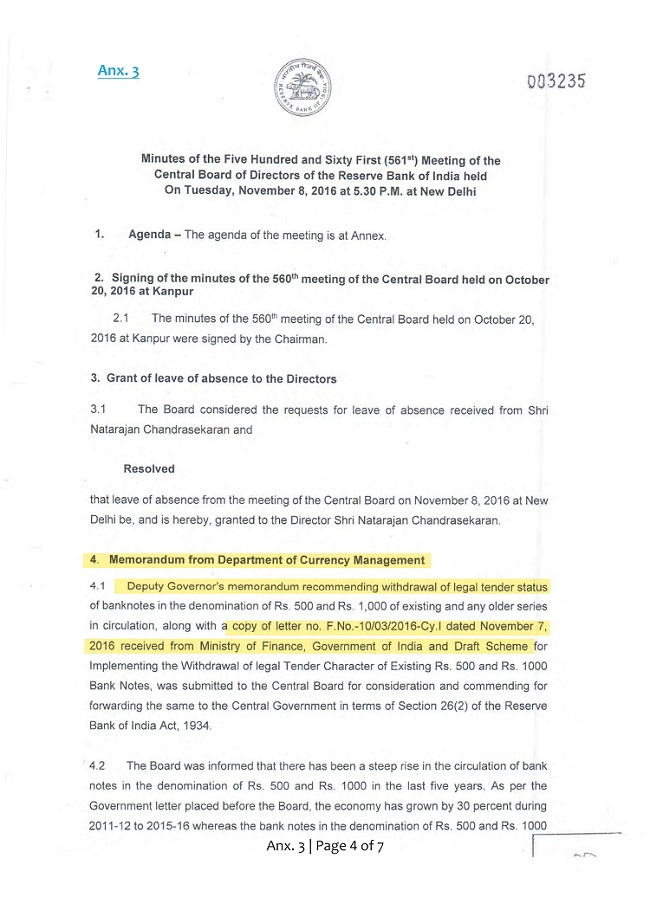

Annexure 2 is titled: “Sequential Legal Regulatory Procedures Prescribed to Complete the Process of “Demonetisation”. This contains a lucid description of various aspects of “Demonetisation” and is intended to help readers gain an in-depth knowledge of the specific legal provisions and administrative compliances which ought to have been followed both by the RBI as well as the Govt. of India during the four Main Phases of this initiative. If either of them had — fully or partially — neglected or failed to follow these legal prescriptions, in all fairness, they owe a satisfactory explanation to Parliament and to the people of India on every point which has been dealt with herein.

A purely professional assessment of the actions leading to the announcement of 8th November 2016 by the Prime Minister clearly indicates gross neglect and violation of relevant provisions of the RBI Act and related Regulations. This is an impartial assessment and is not intended to criticize or blame the actions of those concerned.

According to Section 26(2) of RBI Act, it is only based on the recommendations of the Central Board of RBI to the Central Government that “the latter may by Notification in the Gazette of India declare that with effect from the date(s) specified therein any series of bank notes of any denomination shall cease to be legal tender save at such office or agency of the Bank and to such extent as may be specified in the Notification”.

The term “office or agency” of the RBI is explained in Section 6 of the Act. However, the term “agency” of the Bank requires careful understanding as this is not specifically defined in the Act.

Regulation 8 of the RBI General Regulations 1949 specifies that one clear month’s notice shall be given of each meeting of the Central Board to every Director to his registered address. It further adds that if it should be found necessary to convene an emergency meeting, sufficient notice shall be given to every Director who is at the time in India to enable him to attend. “Sufficient” is a subjective term, hence lacks clarity of real-time necessity.

It is thus clear that the initiative to recommend cancelling the legal tender status to any currency notes must originate from the Reserve Bank of India which should prepare its Draft Report providing reasons and justification for such Proposal and highlighting the benefits that result from such actions. The Report should also clearly mention the expected adverse impact of such decision and possible damage to the economy and inconvenience to the public. The various sequential steps to follow are described in specific terms in Annexure 2.

Annexure 2 also gives an indication of the normal timeline to comply with each of the above steps. These datelines are juxtaposed with the actions, dates and timelines actually followed by the RBI/Govt. of India in the present case. It is for readers to draw Judgement on the practical attainability of the later dates which clearly indicate that both RBI and Govt. of India have bypassed vital procedures. It is reasonable to opine that these violations would not have been committed in the normal course either by the Central Board or by RBI.

The overwhelming point to be noted as it emerges from these records is that the entire act of “Demonetisation” is an idea of the Govt. of India which has been forced on the RBI and people of India without proper consideration of any of the aspects essential before embarking on a misadventure of such unprecedented magnitude.

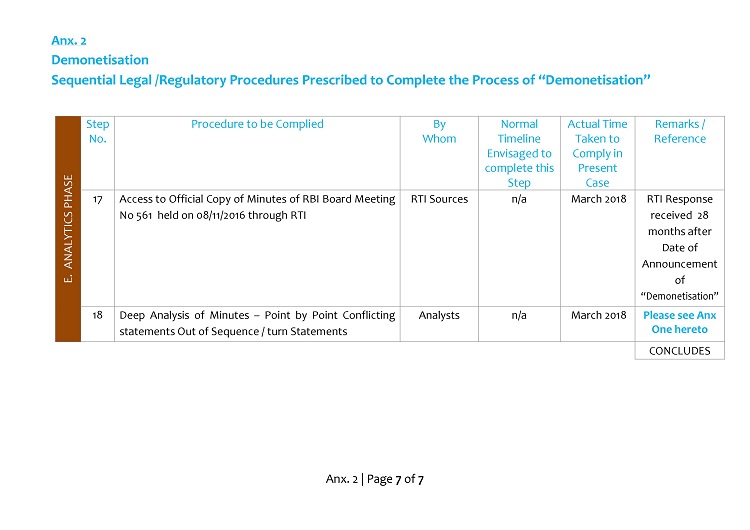

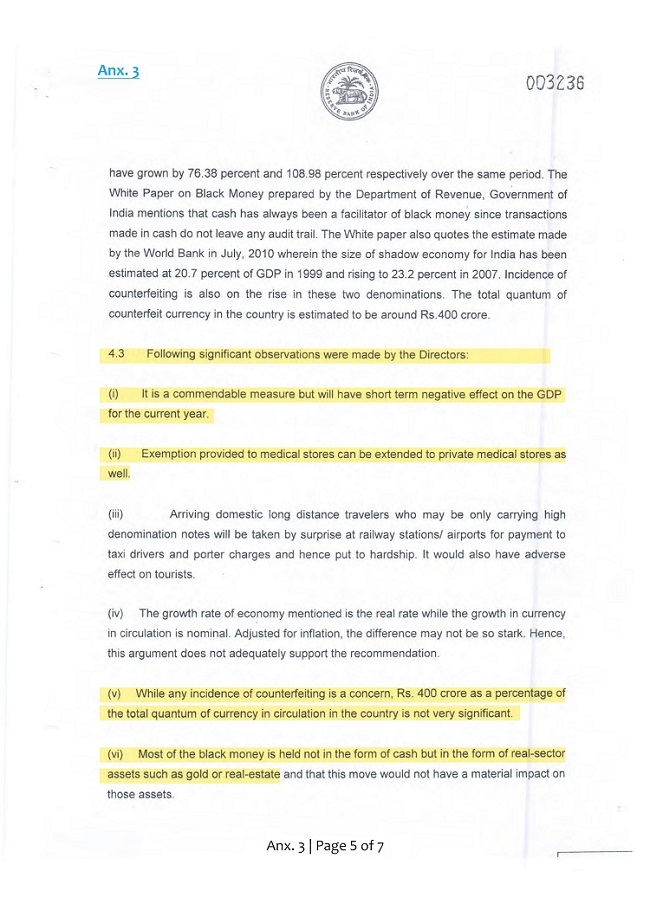

Annexure 3 is a true copy of the Minutes of the 561st Meeting of the RBI Central Board held at 5.30 pm on 8th November 2016 at New Delhi. Following points must be carefully noted:-

The meeting was held barely 2½ hours before the announcement by the Prime Minister on National Television at 8.00 pm, the same evening, declaring “Demonetisation”. It is evident that the Govt. of India compelled the RBI to hold this Meeting to fulfill the requirement of Section 26(2) of RBI Act and create the circumstance required in Section 26(2) that recommendation of “Demonetisation” should originate from RBI. It is impossible to comprehend how such a responsible institution as RBI was compelled to sacrifice its integrity and independence to blindly obey the directions of the Government. Indeed a travesty of regulatory process.

The Resolution passed at the 561st Meeting of the Central Board of RBI held on 8th November 2016 has been signed on 15th December 2016 by the then Governor of the RBI and the Chairman of the said Meeting, which reads thus, “Resolved that the proposal of the Deputy Governor recommending withdrawal of legal tender status of bank notes in the denomination of Rs. 500 and Rs. 1000 of existing and any older series in circulation is hereby considered and commended by the Central Board of Directors for forwarding the same to the Central Government.”

It is strange that the Governor of the RBI refers to the Proposal of the Deputy Governor commending this action as if it came to his knowledge for the first time on 8th November 2016, whereas he should have examined such a serious document far earlier than the said date. Section 26(2) of the RBI Act clearly states that “On recommendation of the Central Board —” it does not say on the recommendation of the Deputy Governor.

Further the Resolution is signed on 15th December 2016 which is 38 days after the Prime Minister’s announcement of “Demonetisation” on 8th November 2016. Truly speaking, this is procedurally incongruous and bad in law.

Under Para 4 of the Minutes of Meeting titled Memorandum from Department of Currency Management, at 4.1, it is recorded thus, “Deputy Governor’s Memorandum recommending withdrawal of legal tender status of banknotes in the denomination of Rs 500 and Rs. 1000 of existing and any older series in circulation, along with a copy of letter No. F.No. 10/3/2016-Cy.I dated November 7, 2016 received from Ministry of Finance, Government of India and Draft Scheme as above was submitted to the Central Board for consideration and commending for forwarding the same to the Central Government in terms of Section 26(2) of the RBI Act 1934.”

The public deserves to know why the Deputy Governor’s Memorandum was considered by the Central Board only few hours before the Prime Minister’s announcement and not weeks/months prior, which should have been the normal timeline. Also, a good explanation is required as to why the Finance Ministry’s letter dated 7th November 2016 was also pushed in to the Meeting of the Central Board on 8th November 2016, whereas this is a process which should have happened weeks / months prior as described in Annexure 2.

It is very important for the RBI Central Board Secretariat to candidly confirm and provide factual documents to substantiate the fact that in the Notice of Meeting to be held on 8th November 2016, the Agenda stated therein was supported by the various documents herein referred and duly attached for the prior knowledge and understanding of each Board Member, in preparation for the said Board Meeting. If these supporting documents are not now satisfactorily made available, there is definite reason to believe that the whole process which ought to have been followed was circumvented.

In para 4.3 of the Minutes of the Meeting, it is amusing to read at sub para (i) that “it is a commendable measure —”. These 5 words totally expose the reality of the subject viz., the whole Proposal of Demonetisation came from the Govt. of India and was not initiated by RBI as required by Section 26(2) of the RBI Act. Being an independent body, it was wholly unnecessary for RBI to praise the Govt. of India. But this proves that the process of Demonetisation originated with Govt. of India. Otherwise, if it indeed originated from the RBI itself as required by law, it would be ludicrous for the Central Board to refer to its own Proposal “as a commendable measure!” So, these 5 famous words have disclosed and affirmed the truth that the Demonetisation Proposal indeed originated from Govt of India.

At sub para (ii), the Minutes record that “Exemption provided to medical stores can be extended to private medical stores as well”. The public are entitled to know whether this exemption was contained in the Scheme prepared by the Currency Management Department or if not, who specified the grant of this relief.

At sub para (v) “the Central Board has clarified that the incidence of counterfeiting is merely Rs. 400 crores which is not very significant as a percentage of the total quantum of currency in circulation.

Therefore, the RBI Board has not construed the prevailing counterfeit currency notes as a reason to recommend “Demonetisation”.

At sub para (vi), the Minutes record that “ most of the black money is held not in the form of cash but in the form of real-sector assets such as gold and real estate and that this move (referring to “Demonetisation”) would not have a material impact on those assets”. Again, the RBI Board has clearly dissented and held that Demonetisation is unwarranted as a measure to counter black money.

However, I would like to respectfully point out that this too is a seriously flawed and myopic view inasmuch as secondary market transactions in both real estate and bullion / jewellery constantly involve the liberal use of cash while changing ownership — a process for which currency is the most fundamental pre-requisite – for both buyers and sellers. This is an undeniable ground reality pan India.

Para 4.4 states that “the Board was assured that the matter has been under discussion between the Central Government and RBI over the last six months during which most of these issues have been considered.” This requires careful understanding.

No discussion between Govt. of India and RBI especially on such a crucial matter could have ever taken place without prior knowledge, consent and approval of the Governor / Central Board, it is therefore a laughing matter that at this 561st meeting, the Board was “assured” as above. Assured by whom? requires to be clarified.

“Most of these issues have been considered”. If indeed these have been considered the views of the RBI Board mentioned in the preceding sub paras (v) & (vi) would have been sorted out at such meetings and would not find space in the present Minutes. Very difficult to understand why Para 4.4 states that “the Board has to be assured that the matter has been under discussion”. The public deserves to have complete set of copies of Minutes of all such Meetings reported to have been held, in order to understand the reality of the entire proceedings, if indeed they were held.

At Para 4.5, it is amusing to know that “the Board was assured that the Government will take mitigating measures to contain the use of cash.” One fails to understand why and how the Board of RBI required such assurances from the Government, at this Board Meeting.

Para 4.6, “The Board considered the Memorandum and after detailed deliberations —” the Board ought to have considered this Memorandum served weeks in advance, and not a few hours before announcement of “Demonetisation”.

Officially, the Resolution signed on 15th December 2016 by the Chairman of the Meeting namely the Governor of Reserve Bank Mr. Urjit Patel states that “— is hereby considered and commended by the Central Board of Directors for forwarding the same to the Central Government.” Considering Paras 18 & 19 above, which clearly reflect RBI’s disapproval of the “Demonetisation” process, how then could be that Board record its Resolution as described above in this Paragraph no. 23? In other words, how could the Board commend an action which it has itself recorded to be incorrect and unnecessary? Frankly, they are contradicting themselves by passing such a faulty Resolution.

Clearly, a great deal of further process remained at the hands of the Central Government after receiving the Minutes duly approved by the Central Board on 8th November 2016 — and signed and officially released on 15th December 2016 — before it could embark on announcing Demonetisation. Unfortunately, the entire timeline of just a few hours could never have been sufficient to make such carefully considered decisions and implement such major actions, as witnessed.

The Minutes have been signed on 15th December 2016. Legally the Government could not have taken on record this Minutes — much less acted upon them — prior to receiving and studying the same. In sharp contrast, we all know how the events unfolded rapidly on 8th November 2016.

At Annexure 4, the Gazette of India N0. 2652 containing publication of Notification No. S.O. 3407(E) regarding Demonetisation is also dated 8th November 2016. If the PM’s Announcement was made at 8.00 pm, it is difficult to believe that the content of the Gazette Notification was sent by the Finance Ministry to the Controller of Publications who in turn sent written instructions to the Directorate of Printing at the Govt. of India Press for inclusion in the Gazette published and released on the same date. These reflect the super human speed of action which is not supported by real life experience.

From Annexure 5, we observe that on the very same date of 8th November 2016, the RBI under the hand of its Chief General Manager has issued “Instructions” to the Heads of all Banks. In this Circular, reference is made to the Gazette Notification No. 2652 of 8th November 2016. This naturally implies that the Circular – with all the details seen therein — was prepared after the Gazette Notification was published which would have been physically seen only on 9th November 2016. Whereas, the RBI’s Circular has been issued almost simultaneously lending credence to the belief that this was prepared in advance and kept ready for issue, long before the Gazette Notification was actually published. The contents of Point No. 2: Action to be Taken on 9th December 2016, in particular instructions at Sub Para (xi) & (xii) as well at Para 3(b) clearly confirm that this Circular was prepared long before the Gazette Notification and kept ready for circulation.

The Minutes of the Meeting of RBI Central Board became available very recently hence the renewed interest on this subject. If RBI had not recommended “Demonetisation” for reasons stated in their documents, how could Government of India forced its ideas on RBI and directed it to abide by its decision to go ahead with “Demonetisation”? It is thus clear that the Government forced its will on RBI and compelled it to concur.

The primordial role of our Finance Ministry in this whole exercise is never explained anywhere though this is the apex operational Ministry for such matters.

The Minutes speak of the Memorandum on this subject being prepared by the Deputy Governor of RBI, but surprisingly his name is not mentioned in anywhere. He had to be authorized in writing in advance to do so either by the RBI Governor or by the RBI Central Board. We desire to know who mandated him to take up this serious exercise and who are the members of the Committee constituted to prepare the Memorandum along with the said Deputy Governor. The Deputy Governor could not have prepared it in isolation considering the weight of the subject and the volume of work involved.

If all proceedings had been followed for over 6 months as stated in the Minutes, then where was the need to call for an emergency meeting on 7th November 2016 instead of following the usual option of a regularly convened meeting, giving one month’s notice to all Directors ?

If indeed, the idea of the Government was to curb the use of black money, why were the erstwhile Rs. 1000 currency notes replaced by the even higher denominated Rs. 2000 currency notes, which facilitate and encourage dealing with cash and thereby support the perpetration of black money transactions? Since the storage space and logistics involved were both reduced by 50%, surely, the Reserve Bank could not have recommended the introduction of Rs. 2000 currency notes and that too, as a replacement for Rs. 1000 currency notes. Undeniably, there are highly knowledgeable and experienced officials in RBI, who would never have put forth such recommendations, and risk jeopardising their enviable reputation.

As far as Rs. 500 notes are concerned a new series has replaced the old series, therefore there is no impact one way or the other on the volume of cash in circulation and its use for unaccounted operations.

As far as counterfeiting is concerned, reports during 2017-18 by Law Enforcement Agencies in India clearly debunk the proposition of the Govt. of India that Demonetisation would deter / eliminate counterfeiting.

As far as use of currency of unaccounted transactions is concerned, the total incidence of black money operations has substantially increased since 2017 assisted by the welcome presence of the higher denomination of

Rs. 2000 currency notes. Therefore “Demonetisation” has not in any way helped abate either the circulation of black money or corruption.

Interestingly — and ironically — the very first reported instance of corruption using the new Rs. 2000 notes took place when an Officer of Gujarat Port Trust was caught receiving bribe money in the new pink coloured notes, as early as the 16th November 2016 — a mere 8 days after the PM’s Announcement of “Demonetisation” and that too, in his own home State. So much for “Demonetisation” curbing corruption. What a travesty of reality vs imaginary expectation! Anyone Listening?

Specific Questions which Deserve Factual Response from RBI and Govt. of India

(I) Why did it take 28 months for RBI to provide copy of Minutes of their Central Board’s Meeting No. 561 dated 8th November 2016, to RTI Activists ?

(II) Did RBI have more to conceal than reveal regarding procedural lapses with regard to “Demonetisation”?

(III) Is RBI guilty of participative / contributory wrong doing by not recording its disapproval of Government of India’s directions concerning “Demonetisation” as they were violative of provisions of the RBI Act?

(IV) RBI’s passive stance on this crucial subject as seen from text of the Resolution passed at this Meeting but signed by the Governor as late as 15th December 2016 contains veiled admission of serious procedural lapses on their part as well as on the part of Government of India to a greater extent.

(V) Being an apex, independent body renowned for its integrity and organisational strength, it was well within the powers of the RBI Board to desist from violating the RBI Act and relevant Regulations thereunder, and instead, submit written disapproval of the Government’s proposed actions which was compulsively forced on it by Govt. of India.

(VI) RBI appears guilty of violating its own Act. What are the legal provisions for such violation?

(VII) If as stated in the Minutes, 6 months interaction between RBI and Finance Ministry/Govt. of India had indeed taken place, where was the need to state and record this in the present Minutes of Meeting No. 561?

The proceedings of all such Meetings held during these 6 months ought to be made available to lend credence to this claim.

Otherwise one would be compelled to conclude that this paragraph in the Minutes was also included at the behest of the Government, to give semblance of procedural compliance by both Govt. of India and RBI to “prepare and plan” for such a major action.

(VIII) How many days prior notice were given to the Members of RBI’s Central Board to prepare to attend the most crucial 8th November Meeting? Was the Board Note accompanied by all the supporting documents necessary to understand and prepare for the Meeting ?

(IX) Two more key documents need to be disclosed by RBI/Government:

(a) Memorandum from RBI, Department of Currency Management referred to at Para 4 of the Minutes of its 561st Meeting.

(b) The letter from Finance Ministry to RBI dated 7th November 2016 referred to therein.

(X) In its Annual Report for 2017-18, RBI has reported on 30 Aug, 2018, thus; “As much as 99.3% of the junked Rs. 500 and Rs. 1000 notes have returned to the banking system. Of the Rs. 15.41 lakh crore worth Rs. 500 and Rs. 1000 notes in circulation on November 8, 2016, when the note ban was announced, notes worth Rs. 15.31 lakh crore have been returned. This meant just Rs. 10,720 crore of the junked currency did not return to the banking system.”

This once again confirms that the view of the Board recorded at Para 4.3 (vi) that “this move would not have a material impact on those assets” stands reconfirmed by this statement in its own Report.

Annexure 1

Annexure 2

© CSS Rao, 2019.

Annexure 3

Annexure 4

Annexure 5