Every once in a while, we receive rather unexpected news at the most unexpected times! And often, such news reflects incomprehensible travesty of common sense, let alone macro-finance prudence.

Some years ago, soon after the November 2016 Demonetisation saga, the Indian Government decided to issue currency notes in the unprecedented denomination of Rs 2,000, ousting the then dominant Rs 500 and Rs 1,000 notes, citing three principal objectives, ostensibly to (1) ‘curb’ black money, (2) ‘deter’ counterfeiting and (3) ‘thwart” terror financing.

Several official government and RBI reports confirm and the ground realities prove that all three objectives have failed. Also, the exact opposite results have come to be: (1) unaccounted commercial transactions generating black money have risen sharply; (2) the Rs 2,000 currency is the most counterfeited (being the most profitable) Indian currency note; and (3) the exercise has had no impact on deterring terror funding.

It is therefore fair to surmise that this entire ill-considered, quixotic exercise of introducing this high-value note has proved to be a serious and costly misadventure, holding the prospect of eroding the government’s credibility.

In this context, the attention of readers is drawn to the deeply-researched, constructive article by this Author, published about a year ago on News Intervention which explains the genesis of the misadventure

1. Official Announcement of Issuance

India’s Ministry of Financehas notified ‘Printing of One Rupee Currency Notes Rules, 2020’ vide Gazette Notification G.S.R. 95(E) dated February 7th, 2020. The One Rupee notes shall be printed at the note printing presses for issue under the authority of government of India for circulation.

The One Rupee currency note would be rectangular (97 x 63 mm) and printed using 90 gsm indigenous rag content security paper, 110 micros thick. It will also have multi-tonal watermarks with Ashoka Pillar in the window. The overall colour of One Rupee Currency note will be predominantly pink green on obverse and reverse in combination with others.

A one rupee currency note carries the signature of the Finance Secretary as it is issued by the Government of India through the Ministry of Finance, while all higher denomination notes are issued by the Reserve Bank of India, bearing the signature of RBI Governor.

2. Rationale

No explanation is available from government sources up to the present time, hence the rationale for its introduction is left to the judgement of readers.

3. Historical Background, Nostalgia

Currency notes were introduced in India in 1861, and the one-rupee note was introduced by the British on November 30, 1917.

According to the Reserve Bank of India, the printing of this note was first stopped in 1926 because its printing was costlier than its value i.e., it lacked seigniorage. After that, its printing was resumed in 1940 but discontinued in 1994. Yet again, it was reintroduced in 2015 after a gap of 22 years. A rather chequered existence!

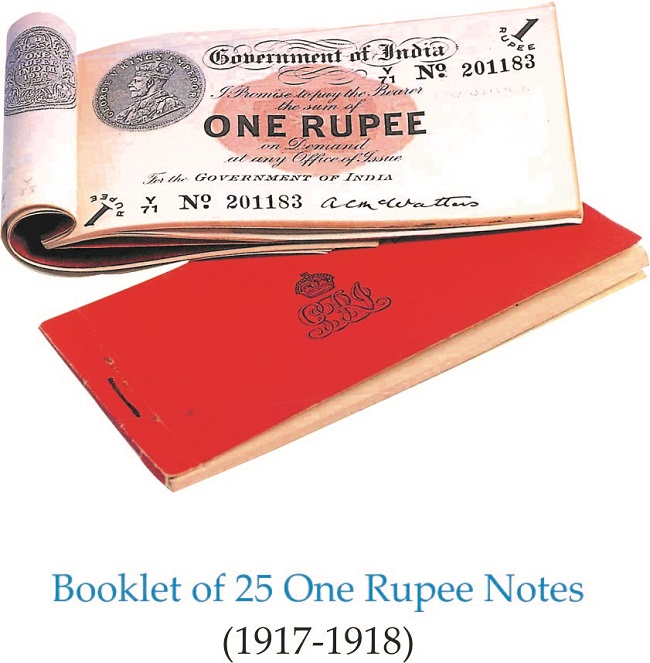

The image below brings nostalgic memories of a bygone era, when a one rupee note was a prized possession owing to its considerable purchasing power. Few people in modern times would believe that they were issued in the form of perforated notes bound together, as the image below of the century-old version shows!

And now, we have this delightful news that the nostalgic One Rupee currency note is being re-introduced with effect from early February 2020! Is it another imprudent decision, devoid of merit and utility? People are free to draw their own inference.

4. Lifespan of Physical Money, Cost Benefit Analysis

The average lifespan of a currency note in India is about one year. It is less for lower denomination notes and more for higher denomination notes owing to their respective velocity of circulation as well as manner of handling.

Seigniorage is a specialised term which represents the revenue earned by a central bank from the issue of money – the difference between the face value of the coin or banknote and the cost to produce and issue it.

As far back as 1926, the one rupee currency note was discontinued as described in para 3 above owing to lack of seigniorage. It is rather strange that the government has chosen to re-launch this note at the present time, when the cost of producing the note is much higher and its usage inconsequential. As is well known, the lifespan of coins is over twenty years, they avoid frequent re-issue which is the case with banknotes, thus reducing administrative costs to the issuing bank. Issuance of coins generates true seigniorage which is not the case with low denomination currency notes. Finally, coins can always be recycled at ‘end of life’ and minted again with minimal loss of metal.

5. India’s emerging needs of Physical Money

Owing to the rapid decline in the intrinsic purchasing power of the Indian Rupee, the government decided several years ago to discontinue minting small denominations coins — lower than one rupee in unit value — that were in use historically. Thus, India is one of the few countries worldwide which does not have sub-units of its currency, unlike for example, the US Dollar or EUR where one euro equals 100 cents. Euro coins consist of eight denominations: 1, 2, 5, 10, 20 and 50 cents and 1 and 2 Euros. This is an existential reality we must get accustomed to and endure.

Notwithstanding the government’s ambitious thrust to migrate to cashless – or less cash – society, the make-up of commercial transactions across our vast country — especially in rural India — reflect a real, emerging need of physical money comprising currency and coins very different from what is presently offered. The sharply rising volume of currency notes in circulation in India from year to year since 2017 is testimony to this reality.

Thus, cash will undoubtedly continue to dominate, at least for the next 7-10 years, though the share of digital and mobile payment modes will continue to rise. The specific recommendations now put forth are summarised as follows:

1. Coins should continue to be issued in denominations of 1,2,5 and 10, with no currency issuance.

2. In addition, a new coin with denomination of Rs 20 should be issued. 1 and 2 both offer excellent seigniorage value.

3. Currency should be issued in just two standard sizes, one for lower values and the other for higher values, each of them in distinct colours, easily distinguishable even in poor light conditions and by people with poor levels of literacy.

4. Lower values would comprise four denominations: Rs 20, 50, 100 and 200.

5. Higher values would also comprise four denominations: Rs 500, 1,000, 2,000 and 5,000.

The valuable lessons learnt by commissioning Rs 2,000 (~ USD 27) denomination notes since November 2016 confirms that there is no real hazard in issuance of high value currency notes, including the new Rs 5,000 (~ USD 70) denomination now recommended. However, it is emphatically reiterated that significantly enhanced, technology based security features must be incorporated in all currency notes issued prospectively – far more stringent than the seriously deficient features of the now disfavoured Rs 2,000 notes in which 7 of the 9 security features have been consistently breached by anti-national elements producing and supplying counterfeit supplies of this much vaunted denomination.

Further, durable polymer based substrates with unique physical properties must be selected. Advanced printing processes and inks incorporating futuristic security elements must be adopted to ensure the authenticity and durability of the currency. These initiatives would significantly preclude counterfeiting even by skilled anti-national agencies – both within and outside our country – claiming expertise in this nefarious art.

On a lighter note, “The new Note will be equipped with several security features” mentioned in the government notification and alluded to at the outset are, in reality, unnecessary since there is no likelihood of counterfeiters wasting their talent and energies on mass producing a valueless denomination such as the one rupee note (~1.50 US cents) now launched. Quite frankly, it offers seriously negative seigniorage — and one would have expected concerned authorities to recognise this truth before announcing the launch of this distractionary ‘novelty’.

Conclusion

Having understood the real issues involved, people can gauge the merits of issuing the new one rupee currency notes vis a vis coins of the same denomination. Time will show who will use the new notes, where and for what purposes – and equally important, whether its issuance offers any advantage to the issuer.

© CSS Rao 2020 All rights reserved.