Yes Bank is a classic case of complete travesty of fate. Not just history but even fraud repeats itself. Compulsively.

Several years ago, when the flamboyant Rana Kapoor launched his overly ambitious enterprise in late 2003 and named it Yes Bank, the first powerful premonition that came to mind was that the self-serving business model of this family dominated bank, which was dressed to appear professionally run was destined to rise and fall rapidly. The flux of time has proved this apprehension unerringly right. Effective 5th March, 2020 this Bank has come under the supervision of the Reserve Bank of India (RBI).

Impressive but Flimsy Track Record

The deft camouflaging of fake large volume transactions, nepotism, favouring unworthy borrowers, repeated acts of money laundering, lending against norms prescribed by RBI, violating code of banking conduct – all for quid pro quo – are some of the highlights of the business style of the gutsy Rana Kapoor, ably assisted by a coterie of “trusted” bank officers, operating level staff, collusive auditors and regulatory inspectors – and not the least, the other Board Members and so-called Independent Directors — without whose abetment, not a single such misdeed could have ever been perpetrated. All of these people are collectively guilty of connivance and contributory negligence.

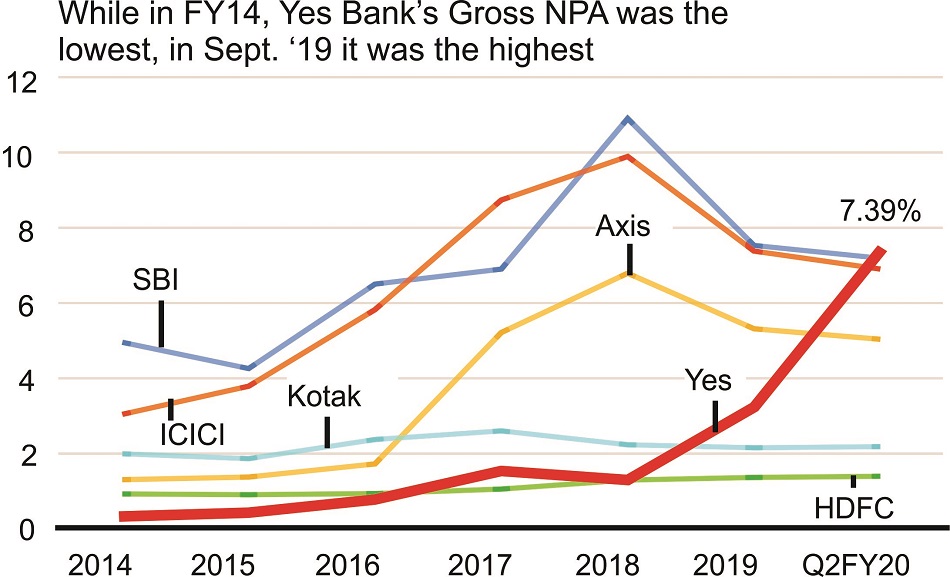

In recent years, Yes Bank was on the path of aggressive growth, following wild and indiscriminate lending decisions by its Board. As on March 31, 2014, the bank’s loan book stood at ₹55,633 crore and deposits at ₹74,192 crore. The loan book grew to ₹2,24,505 crore at the end of the second quarter (September) of the current financial year, while deposits were at

₹2,09,497 crore. So in the last five years, the loan book grew by over four times, but deposits failed to keep pace. Asset quality worsened during this period, with gross non-performing assets (NPAs) going up from 0.31% as on March 2014 to 7.39% . Basel-3 norms were unceremoniously thrown to the winds.

Confidence Drop

Amidst the loan mess, customers withdrew large amounts, resulting in the credit-deposit ratio of Yes Bank crossing 100% (the bank lent more than what it received) in financial year 2018-19. A credit-deposit ratio of 106% means the bank loaned ₹106 for every ₹100 it received.

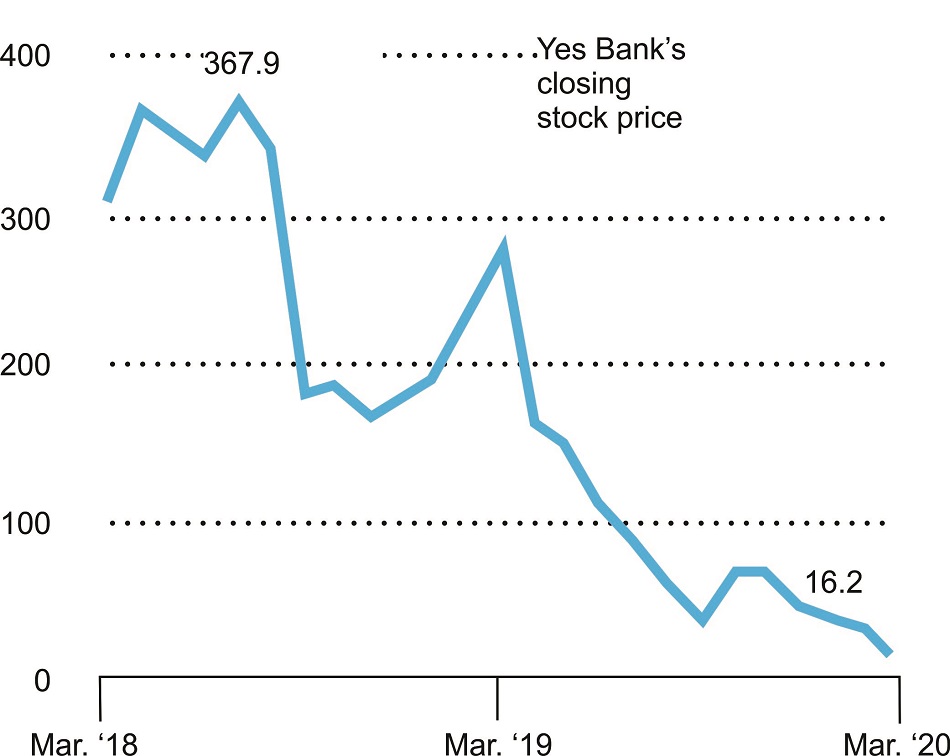

Investors sensed trouble

Though the bank’s troubles came as a shock to many, investors sensed it early. The bank’s stock price fell steadily in the past year.

According to reliable reports received recently from investigating authorities, Yes Bank had provided loans aggregating to ₹3,750 crores to DHFL and ₹600 crore to RKW Developers, an entity controlled by DHFL. They defaulted on payment but got kickbacks of ₹600 crore in Doit Urban Ventures, an entity controlled by close members of Rana Kapoor’s family.

Real Issues to Address: Primordial Role of RBI

But that’s not the real issue being analysed. The most recent adversities faced by this Bank were waiting to happen. Unfortunately, the concerned authorities did nothing to prevent the catastrophe from happening despite visible forebodings.

The iconic Reserve Bank of India, established under the RBI Act of 1934 long before India gained Independence, is a magnificent Institution by any measure. Like all central banks, RBI is always expected to remain completely independent from the national government in power and function with unfettered power and total freedom to safeguard the country’s monetary system and promote the national economy.

Clearly, as events on record prove, RBI has failed to fulfil its cardinal role, thus adversely impacting its credibility and pre-eminent stature as India’s admired apex financial regulatory authority. Let us understand the three main reasons for this.

Firstly, it has often yielded to directives in the past from the national government — regardless of party in power — thus compromising its independent decision-making and operational authority. This forced a series of resignations of top RBI officials unprecedented in its long and illustrious history of over 85 years. They were all men of high professional calibre and personal integrity, who were unwilling to work against their conscience and unprepared to serve as ‘yes men’.

Secondly, RBI has failed to institute stringent control mechanisms to effectively prevent the occurrence (recurrence) of (a) serious bank frauds and (b) significant levels of non-performing assets (NPAs) in both the public as well as the private sector. It has neglected to introduce preventive measures and early warning systems capable of detecting and controlling these problems in their nascent stage, instead of allowing them to escalate to full-blown crises. The central bank’s intelligence system has proved to be woefully inadequate.

Thirdly – and the cause of the second deficiency — there has been a sharp decline in governance standards and oversight mechanisms covering commercial banks, which RBI is expected to follow consistently, covering all facets – not just policing — of this vital sector of the national economy.

Specific Forewarning Published October 2019

In a deeply researched article published as far back as 13th October 2019 in New Intervention, this Author provided a thorough analysis of the deeper causes which resulted in PMC Bank’s failure. In this article, the Author had prophesied as follows, under the sub-section titled: PMC is not the last Case: “ ….it is evident that the rot is very deep in India’s Financial System. Beyond doubt, the replication of several PMC-type frauds are already in the making, perhaps on a larger scale.”

“Yes Bank is a classic example of misuse of bank resources, as their own records acknowledge. Their shares have lost 96% of recent market value.”

It’s sad that the RBI did not take any action, until the bubble burst recently.

Clearly, it is only the RBI which should accept blame for this latest tragedy, because perpetrators of financial crime will continue their misdeeds unless prevented from doing so by means of stringent regulatory practices and in-built systemic safeguards.

A series of very deeply considered recommendations have already been put forth in my earlier article on PMC Bank. Each and every recommendation therein is relevant to and applies equally, perhaps more so to the Yes Bank. Readers are invited to refer my earlier article by clicking in this link.https://newsintervention.com/pmc-bank-scam-is-indication-of-the-systemic-rot-in-indias-financial-sector/

Urgent Actions now Required by Government of India, Platitudes Apart

It is time the Government decides on interceding to prevent recurrence of such frauds in our economy which is already languishing for a variety of reasons.

Post PMC Bank’s fiasco, the RBI Governor said “our Banking System, including co-operatives, are safe, sound.” His unwarranted platitude now echoes with magnified hollowness and greater falsity. Do our trusting investors and harmed depositors deserve to lose their precious monetary resources arising from systematic fraud perpetrated by wily promoters of private banks? Can we subscribe to the tenet that profits are privatised while losses are nationalised?

Can Indian entrepreneurs not present a better picture of themselves to the world and shed this fraudulent stance? Can bank employees and auditors not stop colluding with unethical Promoters and Directors? Can our regulatory systems not become truly effective?

The entire gamut of remedial actions necessary to prevent such gross misdeeds involving thousands of crores of rupees of unsuspecting depositors has been clearly defined in my earlier article on the PMC Bank. What may now be added is the strong recommendation that RBI must create a new, independent Intelligence Wing, with a specific mandate to discreetly gather inside information of key decisions and developments in all banks and financial institutions. Offices of this Intelligence Wing would be located in all State and Union Territory capitals.

The information so gathered should be aggregated and analysed to draw up distilled reports which are then provided to the herein recommended Intel Sub-Committee of the main Board of RBI on a monthly basis – as well as on need-based ad hoc basis — including its perception of emerging financial risks and pre-emptive actions recommended by it to the RBI. Serving and retired officers from India’s law enforcement agencies must be inducted to support the functioning of this RBI’s Intelligence Wing. Trusted employees must be chosen to serve as implants and informants in key offices of banks in all States and UTs. Their skills would lie in prompt early stage diagnosis of financial crime-in-progress and swift reporting misdeeds in their nascent stage to deter their damage. This activity calls for close and regular interaction with SEBI, stock markets, other banks and financial institutions, MCA, corporates etc to gather useful early-stage clues of possible irregularities in the offing.

It is also recommended that the Government of India take urgent steps to constitute a Joint Parliamentary Committee – assisted by an independent team of senior experts including former RBI and Finance Ministry operating chiefs — to review the governance standards and oversight practices covering commercial banks and financial institutions presently being followed by both RBI and the Ministry of Finance in their respective domains. This exercise must culminate in the time-bound formulation of new, thoroughly overhauled regulatory practices incorporating stringent measures to pre-empt fraud and raise deterrent procedures, aimed at safeguarding precious public monetary resources of our country.

In the following phase, RBI and Ministry of Finance must initiate coordinated actions based on these prescriptions, with a sense of deep commitment and urgency. It is further recommended that a randomly composed Special Audit Group — variable annually – closely oversees the very functioning of RBI’s Governance Systems and certify their soundness periodically.

End Note

The money spent on implementing and persevering these recommendations year after year would be but a fraction of the colossal losses being presently faced by the India’s banking sector.

Sending a few people to jail is not the answer because these people anyway knew this would be their ‘guest house’ during the coming days; and yet, they chose to willfully commit such acts of serious fraud. They will soon get accustomed to their new interim habitat, as courts will grant them bail in a few months, enabling them to return to their life of luxury. Their cases will then prolong for many years. Public memory being short-lived, the whole episode will soon be forgotten, much the same has happened in the cases of Global Trust Bank, Satyam, Nirav Modi, various Chit Fund scams, and other unpardonable ignominies across India, which have now faded or are in the process of receding into history.

The real solution lies in making the entire banking system fraud-proof on an enduring basis, using the valuable recommendations comprising preventive measures and comprehensive know how already offered by this Author. Readers are now free to draw judgement and respond on social media or file PILs in the interests of our economy and the people who contribute to its economic well-being. Without waiting for another tragedy to occur in our crises-hit banking sector which is already in shambles — tottering to rise equal to the task of being able to support the attainment of the much vaunted $5 trillion economy by 2025, which – believe it or not – calls for a sustained GDP growth rate higher than 14% year on year– a complete myth in the absence of a flawless, robust and trustworthy banking system.

© CSS Rao 2020 All rights reserved.