An interesting story doing the rounds in the Indian Capital revolves around the former Finance Minister P Chidambaram who does not lose a single opportunity to attack Prime Minister Narendra Modi. Except, every time he fails to cover his tracks and gets heavily trolled.

Chidambaram’s twitter messages criticising the government on the Farm Bill brought a large number of protests, and almost like the ghost of Julius Caesar stirred his conscience, especially in the light of his alleged role, and the alleged role of his favourite bureaucrats, Ramesh Abhishek and KP Krishnan in destructing National Spot Exchange Limited. Till the time of the Rs 5,600-crore payment hit the exchange — remember it was not a scam of the magnitude one sees almost every month — NSEL was considered the best example of what is now popular as Atmanirbhar Bharat or Digital India.

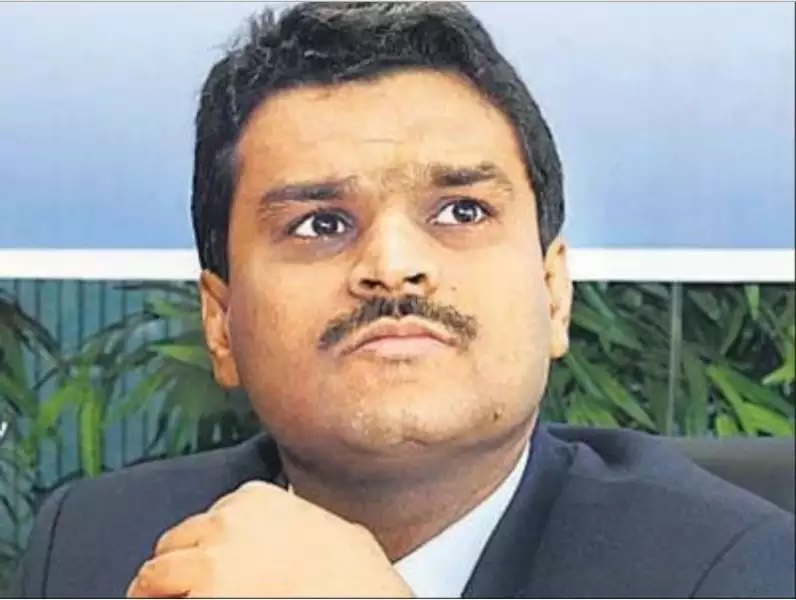

Chidambaram’s alleged role in destructing NSEL has been well documented. That the former FM and his favourite bureaucrats did not like the meteoric rise of Jignesh Shah, the promoter of NSEL, and reportedly wanted to favour the National Stock Exchange (NSE), now in the heat of a serious colocation scandal. For almost 24 hours, the twitter handle of the former FM was bombarded with comments from those who felt a genuine Made In India institution was destroyed. It was like many Caesar’s ghosts appearing to Brutus (read PC) and stirring his conscience for his past acts as well as disturbing him as he pondered his future battle. The messages highlighted works of Shah, a man who once created some of India’s finest exchanges before manipulative politicians and scheming industrialists queered his pitch. Many are now surprised as to how Shah, chairman emeritus of 63 Moons Technologies, the rechristened version of the Financial Technologies – the erstwhile parent holding firm for all the exchanges founded by him – has emerged as a Phoenix, a mythical bird with fiery plumage that lives up to 100 years.

Very few know NSEL was one of Shah’s smallest ventures.

In a landmark judgment on April 30, 2019 the Supreme Court prevented government’s move to merge NSEL with 63 Moons Technologies, and now, other courts are opening up the bank accounts and assets of 63 Moons Technologies. The big issue of corruption that once PC and his men heaped on Shah has not stuck on the sleeves of this affable visionary. Court orders are absolving him of all the charges one after another as no agency could prove even a single paisa of wrongdoing on his part, nor on the part of his companies.

Seven years have passed since NSEL got engulfed in the crisis, Shah has routinely maintained it was an “employee fraud” done in connivance with some defaulter brokers. He has said the crisis could have been solved in a month and half but for a political conspiracy hatched at that time to help his business rivals. Shah, who had to eventually exit all the exchanges and related businesses set up by him, including the flagship Multi-Commodity Exchange (MCX), is still hopeful about the resolution as also about punishment to all those who were party to the fraud. He has tremendous faith in Prime Minister Narendra Modi. He has been trying hard to work on the recovery process and refund of dues to all genuine claimants, the cash trail of Rs 5,600 crore that is missing has been established and assets worth over Rs 8,000 crore of defaulters have been attached. There is more, Rs 3,300 crore of decrees and arbitration awards have been obtained and the same for the balance amount was underway.

The 52-year-old Shah, popular as India’s Exchange Man, had successfully launched 14 exchanges across six continents, a global record. He has been hauled over the coals but he has always said he has had great faith in the judiciary. His companies were number one in commodities trading, electricity, currency, bonds and in everything they were doing.

63 Moons has filed a defamation suit, seeking Rs 10,000 crore in damages, against Chidambaram, Abhishek and Krishnan, alleging it was facing continuous “targeted and mala fide actions” in the wake of an “engineered payment default crisis” at the NSEL.

It was on July 12, 2013, the Forward Markets Commission (FMC), the then regulator of commodity exchanges, directed NSEL to give an undertaking that it would not launch any fresh forward contracts of one-day duration—for which it was given permission earlier—and settle all the existing contracts on their respective due dates. The FMC move triggered tremendous panic in the market, sellers emptying their godowns to meet their other commitments, and defaulting on their NSEL commitments, resulting in the otherwise avoidable payment crisis at NSEL on July 31, 2013.

It is important to see the crisis in its totality. For example, as sudden withdrawal of cash by depositors creates trouble in a bank, likewise the order to settle all outstanding contracts alarmed the market, leading to an otherwise avoidable payments crisis. The crisis was blown out of proportion. It was alleged that 16,000 investors had lost Rs 5,600 crore on NSEL.

One needs to remember that NSEL was not an investment vehicle, but a trading platform for buying and selling plantation and farm commodities and their products. More importantly, the Bombay High Court on August 22, 2014, observed that these so-called investors were nothing short of “bogus traders”. Let us not forget that in that very order, the court specifically observed that the then Economic Offences Wing (EOW) of the Maharashtra government “had not found any money trail leading to either NSEL or FTIL and that the entire money lay with 25 defaulters. This was again, after one year, was independently confirmed by the EOW to the then Union ministry of consumer affairs.

The recent colocation scandal at NSE has again established that the brokers — who routinely lure exchange officials — are the true culprits behind financial scandals at the markets. And when such mischievous deeds are done in the face of regulations, government officials in regulatory bodies, as also in the ministries, and even the ministers concerned, are involved behind such nefarious acts.

The markets would have been in safe hands if NSEL had functioned. Let us not forget that for generations, millions of India’s small and marginal farmers have been living in abject poverty because of problems that exist in the country’s tightly controlled agriculture sector. If exchanges that benefit the farmers existed, the nation would not have been a massive dip in farming as an occupation. NSEL’s vision was to liberate Indian farmers from the archaic mandi structure and free them from the shackles of middlemen, the very reason why the Modi government has passed the three farm bills.