In what appeared to be a strong signal to the market regulator, Securities and Exchange Board of India (SEBI), a Chennai-based investor has moved the Madras High Court and SEBI against a Mumbai-based company, India Infoline Finance Ltd (IIFL), from going ahead with the public issue of secured and unsecured redeemable non-convertible debentures to the tune of about Rs 2,000 crore.

The move is significant because Rakesh P. Sheth, a shareholder of IIFL holdings, has filed a public interest litigation (PIL) and contended that the public issue was in complete breach of the prosecution of sanction by the Serious Frauds Investigation Office (SFIO) earlier this month against the company, which it alleged was one of the prime accused in the infamous NSEL scam in which “Rs.5,600 crore was swindled and 13,000 people left high and dry”.

In a first in independent India, NSEL, a running exchange was forced to close down, the petitioner said. Sheth said in the petition that IIFL is none other than the associate company of IIFL Commodities with common shareholders and common directors.

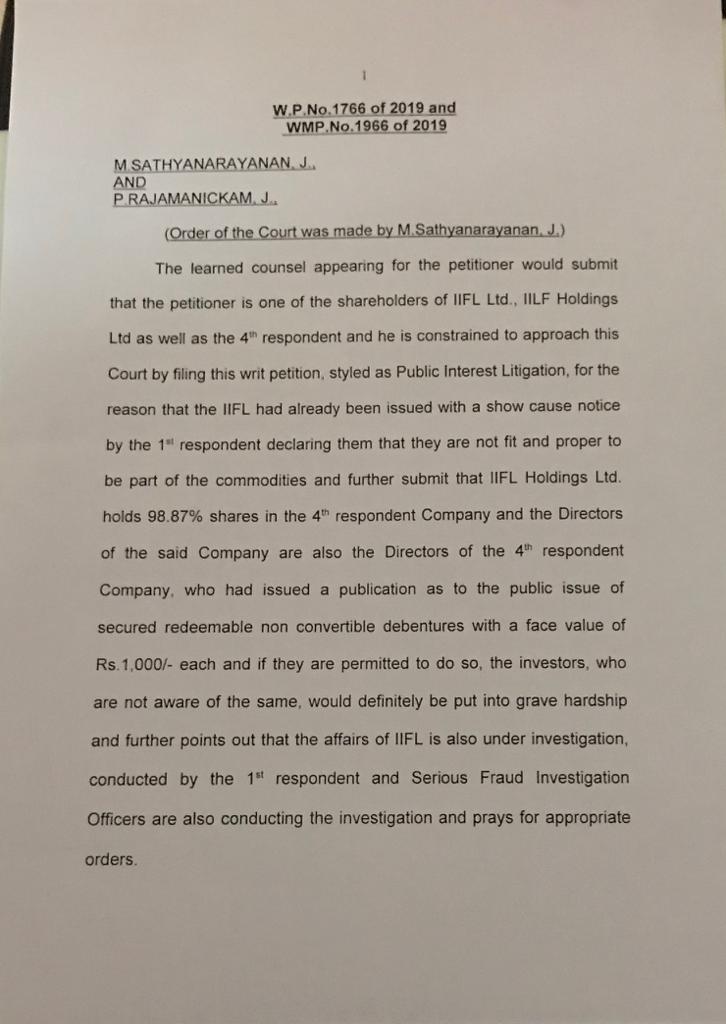

Justices M Sathyanarayan and P. Rajamanickam observed that the counsel for the petitioner had submitted that IIFL had already been issued with a show cause notice by SEBI declaring them that they are not fit and proper to be part of the commodities. The petitioner prayed that the court issue a writ of mandamus directing IIFL not to proceed with the public issue.

“Therefore, when the same management is under investigation, the fourth respondent (IIFL) should not be allowed to access funds from the market. The detailed fraud which has happened in the NSEL scam has been captured by the Bombay High Court in its order dated 04.12.2017,” he said.

The court has issued notices to both SEBI and IIFL.

The Madras High Court notice has set the cat among pigeons. Top Mumbai-based brokerages, which had routinely evaded all kinds of scrutiny and punitive action in the much-debated and till-unresolved NSEL payment crisis, are wondering what will happen next.

Order by the Madras High Court

For the records, the Economic Offences Wing (EOW) of the Mumbai police has issued fresh notices to 300 NSEL brokers, asking them to produce the details pertaining to their transactions on the exchange, the volumes, and even the brokerage earned. The police have done a forensic audit as well as a digital forensic audit of the brokers who defaulted in August 2013.

The market regulator has also issued show cause notices to 300 NSEL member brokers. In the case of top five brokers, it has completed a fresh hearing also and now decision is pending. SEBI has also alleged brokers indulged in frequent changes in client code, mis-selling and assured fixed returns.

IIFL said the court has not given a stay on the Bonds issue and that the matter is listed for hearing on March 6, 2019. “The court has not granted any stay on the petition filed against IIFL Finance’s NCD issue. The case is posted for March 6, 2019. The NCD issue progresses on schedule,” IIFL said in its statement.